The following information is excerpted from the Empire Center for New York State Policy:

New York’s local property tax levels are exceptionally high by national standards and have grown by more than double the inflation rate over the past decade, justifying the governor’s push to limit future growth.

New Yorkers have long paid some of the highest real property taxes in the country, with homeowner taxes in most of the state ranging from 30 percent to 178 percent above the national average as a percentage of property values.

Between 1999 and 2009, total property tax levies outside New York City increased by 5.4 percent a year, more than double the average inflation rate of 2.6 percent. School taxes grew the fastest– an average of 6.3 percent a year. Property taxes in New York kept going up even as property values, personal incomes and consumer prices were going down during the severe recession of 2007-09.

Average taxes

School taxes accounted for 61 percent of all property taxes levied in New York as of 2008, and for 59 percent of the average residential property tax bill. There is fairly wide variation in this proportion, from as low as 34 percent in Allegany County to as high as 85 percent in Suffolk County. But school taxes are more than half the average residential tax bill in 42 out of the 58 counties outside New York City.7

Heavy property tax burdens strain household budgets and drive up the cost of doing business throughout Long Island, the Hudson Valley and upstate New York. In downstate suburbs, high tax bills put home ownership further out of reach for many young families. In less affluent upstate communities, high tax rates undermine property values and feed a vicious cycle of disinvestment in urban real estate.

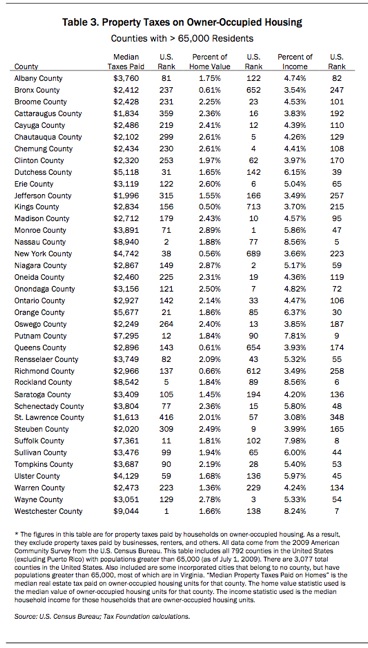

The Table below is based on information from the Empire Center for New York State Policy:

Property Taxes on Owner-Occupied Housing

| County | Median Taxes Paid | U.S. Rank |

| Nassau | $8,940 | 2 |

| Putnam | $7,295 | 12 |

| Rockland | $8,542 | 5 |

| Suffolk | $7,361 | 11 |

| Westchester | $9,044 | 1 |

Disability Expenses

Under general municipal law 207-A and 207-C respectively, firefighters or police officers (including sheriffs deputies) who suffer a disabling injury in the performance of “their” duties are entitled to continue at full salary until the disability has passed or they reach the maximum retirement age, whichever comes first. Firefighters outside New York City who are retired with a performance of duty pension receive 100% of their salary tax free until age 70 plus whatever annual raises and longevity increases are granted to active firefighters. This amount is almost always supplemented by the tax free social security disability payments.

Arbitration Process

At a minimum, some changes in the arbitration process can help control costs without undue disruption of the process. The most heavily weighted issue in interest arbitration should be the question of whether there is “ability to pay” on the part of the community whose taxes must support a pay increase. In making this determination, the arbitration panel should look beyond simplistic fiscal capacity measures, such as constitutional tax limits, to consider and analyze potential tax increases, total tax burdens and the income of the taxpayers who live in the community.

Triborough Amendment

Repeal the Triborough Amendment. It should come as no surprise that public employee unions have fought strenuously to preserve the bargaining leverage they gained from the Triborough Amendment. Elected officials, at the state and local level, need to take a broader view. The public interest is poorly served by a law that makes it easier for unions to hold out against any effort to change costly, outdated contract provisions during a period of intense fiscal and economic stress.

Repealing the Triborough Amendment would leave intact the entire Triborough Doctrine, which preserves the major elements of a contractual status quo after an agreement expires. Contrary to union assertions, this would protect all of the most important benefits public employees receive under the current contract. At the same time, it would give employers the ability to truly freeze employee wage increases in the absence of a new contract. The result would restore some balance to a collective bargaining system that now disproportionately favors unions at the expense of taxpayers across New York State.

Relevant Links to Articles and Resources

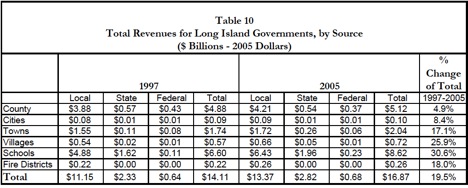

Who Provides Services on Long Island, Long Island Index

Blame It On The Pols, New York Post (Source: Manhattan Institute)

Suffolk Needs State Control Law, Newsday

Nassau’s Wildly Lavish Police Pay, Newsday

MTA Payroll Tax is Destroying Long Island’s Wealth, The Independent Sentinel

LIRR Pension Fraud Probe Charges 10 More Retirees, Huffington Post

Help NY Local Governments Manage Money Woes, Newsday Editorial

27 Retired Long Island Educators Collect Pensions of More Than $200K a Year, Port Washington Patch