Check out the most comprehensive mandate relief/taxpayer protection legislation yet submitted in the New York State Legislature!

Center For Cost Effective Government President Steve Levy Holds Press Conference In Albany To Advocate For Mandate Relief

Members Of The Center For Cost Effective Government Joined With Taxpayer Advocates Across The State To Support Assemblyman Fitzpatrick’s Mandate Relief Bill

A Better Way to Fund Medicare

The Center is undertaking an analysis to determine the best way to fund and operate Medicare. We will provide findings as to whether the enhanced usage of Medicare Part C Advantage Plans can be more cost effective and prevent the system’s ultimate collapse. One concept being evaluated is whether the system should be totally paid for through Medicare taxpayer funds yet simultaneously fully delivered through private Part C healthcare systems.

Analyzing The Allocation of Transportation Funds

The Center for Cost Effective Government is analyzing how the Federal government distributes funds at Metropolitan Planning Organizations across the country. Each MPO in the nation is allotted a specific amount of revenue to aid in the operation and maintenance of the metropolitan areas, as well as preserving the present infrastructure. Long Island is more populous than all major cities in America except for New York City and Los Angeles. The Center is analyzing whether the creation of a separate MPO for Long Island would provide far greater allocation of funding for proper operation, maintenance, and preservation of the Island’s infrastructure.

Purchasing Consortium

The Center is working with a group of districts and municipalities to save money by helping them purchase commonly needed items in bulk. There is an online portal where districts and municipalities can inform each other of when they are purchasing and check to see if they would like to purchase goods together. Click here to access it.

The Center is coordinating with state legislators in bringing together all superintendents from within a single town to facilitate the creation of this type of consortium.

Making School District Purchases More Affordable

The Center is working with Senator Phil Boyle in drafting legislation that would allow for state reimbursement for school district purchases regardless of whether it was through the BOCES list. A Long Island Business News article noted how some districts paid much more for desks, tables, and other furniture through BOCES than they would through a competitive process simply because state aid is available for the BOCES purchase. Were the state were to allow reimbursement for purchases outside of BOCES, the incentive to purchase a more expensive item would be greatly diminished.

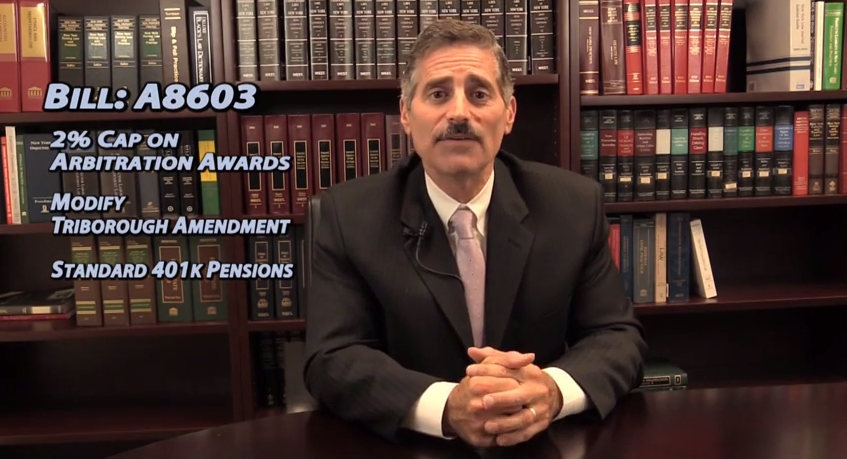

Mandate Relief

The Center is working with associations of towns, villages, and counties to curb the impact of burdensome mandates on local governments. Particular attention will be paid to reforming public sector pensions, mandatory arbitration, disability, fraud, and New York’s Triborough amendment.

The Center supports Assemblyman Fitzpatrick’s Mandate Relief Bill. A summary of the bill is here.

Union Leave

The Center is preparing litigation to end “union leave” in New York State. Presently, union leaders are paid to take time off from their civil service jobs to commit time to running their unions. This includes the time they spend lobbying state and county government officials on behalf of the unions. As a result, taxpayers are funding these union leaders’ leaves of absence to seek more taxpayer money for the benefit of their unions. We believe, and state legislators in Michigan and a lower court judge in Arizona agree, that this practice is unconstitutional, or, at the very least, it qualifies as an unlawful gift with no purpose. These union leaders are being paid by taxpayers to lobby against the taxpayers’ interests. The union leaders should be paid from union dues.

Educating the Public on the Constitutional Convention

This November, one of the most important propositions of the last 20 years will be on the statewide ballot, and few, other than political insiders, are even aware of it. That public referendum will determine whether or not New Yorkers will convene a convention to amend our state constitution.

Our center has been traveling the county to provide residents with the history of the Constitutional Convention and what is at stake as this ballot proposition comes up for public vote in November of 2017.

Returning Illegal Surpluses to the Taxpayer

Hundreds of millions of taxpayer dollars Island-wide are being improperly held by districts in accounts that exceed the 4% escrow limit. This is money that can and should be used to lessen the burden on our beleaguered taxpayers.

The Center for Cost Effective Government recently joined attorney Laureen Harris and other taxpayer advocates in meeting with representatives of the state Comptroller’s office to discuss the lawsuit Ms. Harris is bringing on behalf of the Association for a Better Long Island. The suit tackles the improper accumulation of excessive school reserve funds and its impact on increasing our taxes.

We are seeking legislation for schools that would mirror laws already on the books that pertains to the MTA. The bill would require that where the school district is shown to have improperly kept reserve levels above the statutory limit, the Comptroller could withhold a like amount of state aid to that district and instead return it directly to the taxpayer.

Eliminating Triborough

The Center is mobilizing to encourage the recently established New York State commission evaluating educational reform to eliminate the Triborough Amendment, which requires municipal employee step salary increases to be paid even after the union contract has expired. These double raises not only burden the taxpayers, but also mitigate the incentive for the union to provide any concessions to management in negotiations. Click here to read the Center’s testimony.

Lowering Village Police Costs

Research conducted by the Center has confirmed that taxpayers in Long Island’s many villages are being hit hard from their funding of village police departments. This is primarily due to the fact that even small, rather sleepy villages are often required to follow mandatory arbitration laws that propel law enforcement salaries into the stratosphere. The Center is examining whether the villages can save dramatically by converting to a public safety system that relies more on part-time, retired police officers rather than from full-time units that are collecting health care benefits, pensions and over-time.

Promoting Redistricting Reform

The Center has thrown its support behind an effort in one of New York State”s largest town, Brookhaven, to remove the redrawing of council district lines from the incumbent politicians and transfer that power to an independent panel. Mitigating “gerrymandering” is a needed step in enhancing public confidence in the system, lessening partisan gridlock and creating more competitive elections. Click here to read The Center’s testimony.

Rescind MTA Payroll Tax

We are continuing the fight to eliminate what we believe is an improperly imposed payroll tax on businesses, governments, and not-for-profits, to help support a transit system that many of these entities do not use. Advocates have succeeded in mitigating a portion of this tax, but the remaining payroll taxes continue to reek hardship on business trying to make ends meet. The Center continues to work with attorneys who are litigating against this tax while we maintain pressure on the MTA board to end this tax and to make up the revenues through greater efficiencies.

The Center also assisted Reclaim New York in its effort to expose waste in the MTA and how it has affected delays for commuters. Below is a YouTube segment prepared by one of our members, Bill Schoolman, that highlights many of the inefficiencies inherent in the MTA system.